Inflation Protection (Cost-of-Living Adjustment)

Inflation Protection (Cost-of-Living Adjustment)

A pension with inflation protection —also called indexing— means your monthly payments increase over time to help keep pace with rising costs on things like groceries and rent.

At CSSB, cost-of-living adjustments are not guaranteed, but retired members have typically received them in most years. The level of increase depends on available funds and may only be a partial increase.

Once given, adjustments are yours for life.

How increases are funded

When you were a working member contributing to the pension plan, your payments went into two accounts:

- Civil Service Superannuation Fund (89.8%)

This account funds the pension. - Cost-of-Living Adjustment Account (10.2%)

This account funds cost-of-living increases and pays for about half of each increase. The remainder of the increase is paid for using investment income and employers pay the rest.

How increases are decided

Each year, an actuary determines if an increase can be given and how much it should be.

They look at two main factors:

- The prior year’s Canadian Consumer Price Index (this measures inflation)

- The money available in the Cost-of-Living Account

Decision points

- If there is enough money in the account to cover all cost-of-living payments for the next 20 years, then the full cost-of-living increase is given. Using the 20-year standard is a safeguard for ensuring long-term security.

- If there is not enough money in the account to cover all cost-of-living payments for the next 20 years, the increase can’t be more than 66.67% of the Canadian Consumer Price Index for the previous year. For example, if the index was 10%, the increase can’t be more than 6.67%.

• This limit is set out in the Civil Service Superannuation Act.

• Depending on the funds available, the increase may be lower than 66.67%. - The actuary shares their recommendation with the Board. The Board can either accept or change the recommendation.

Canadian Consumer Price Index

Statistics Canada developed the Canadian Consumer Price Index to measure inflation. To do this, they compare the cost of the same goods and services (e.g., food, housing, clothing) at different points in time to see if prices go up.

Important to know

- Increases are not guaranteed.

- Once given, increases are part of your pension for life.

- Increases are based on the lifetime pension amount, regardless of the payment option you chose at retirement. If you selected an option that provides a different payment structure (e.g., two-thirds to survivor), your cost-of-living increases will still be calculated based on the original lifetime pension amount.

- When you (a retired member) pass away and your pension continues to a spouse, common-law partner, or other beneficiary, increases reduce to two-thirds or 66.67%.

When increases are given

If a cost-of-living adjustment is approved, your first increase is given in the 13th month after you retire and then every July after that.

- If you have been retired for 13 to 18 months on July 1 (meaning you retired between January 1 and June 30 of the prior calendar year), you will receive a partial increase in the 13th month and in July of the same year.

- When you have been retired for 18 months or more, you will receive a full cost-of-living adjustment in July.

For example, if you retired in April 2023:

- May 2024 – first increase (pro-rated to the 13th month after retirement)

- July 2024 – partial increase (as you have not yet reached 18 months of retirement)

- July 2025 – first full cost-of-living adjustment

This schedule ensures all members eventually align with the plan’s annual adjustment cycle in July.

2024 increase

2024 cost-of-living adjustment: 1.2%

2023 Canadian Consumer Price Index: 3.4%

66.67% target => 35.3% achieved

History

Before to 1977, cost-of-living adjustments were granted on an ad hoc basis.

Inflation, longevity, and retirements: A funding challenge

The cost-of-living account is struggling to meet its target for several reasons:

- Rising inflation

- The funding formula

- Changes to membership

- Increased longevity

Rising inflation

Higher prices for goods and services require larger increases.

The Funding Formula

With the current funding formula, contributions can’t keep up with payments.

Changes to membership

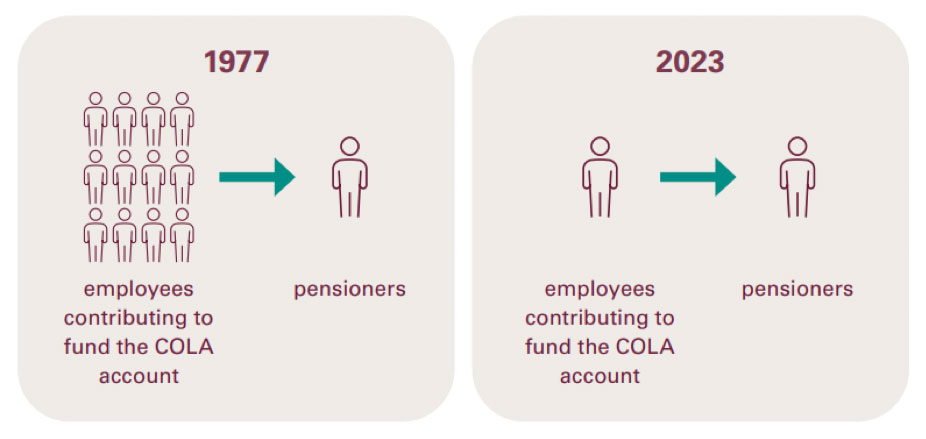

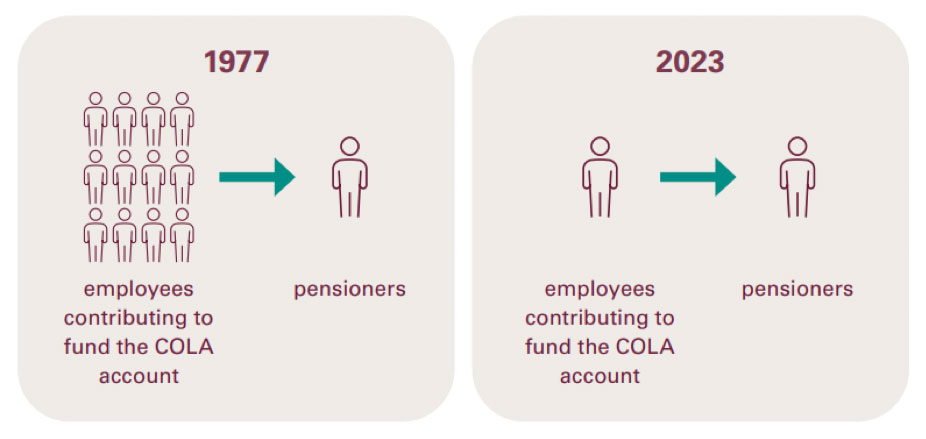

In 1977, there were 12 employees contributing to the account for every one pensioner receiving an adjustment. Now there are only 1.2 employees for every pensioner receiving an adjustment.

Increased longevity

Between 1970 and 2025, Canada’s life expectancy increased from 72 to 83, growth of almost 11 years.1 While increased longevity is worth celebrating, pensions must now stretch further and adjust more often.

Concerns for the future

If pension payments stay the same while costs continue to rise, pensioners lose buying power, leading to a lower standard of living. For over 20 years, the Board and actuary have warned that the cost-of-living account can’t meet its target. They have also indicated this trend is likely to continue unless changes are made.

Changes start with two committees:

- Superannuation and Insurance Liaison Committee (representing employees)

- Employer Pension and Insurance Advisory Committee (representing employers)

Both committees must make recommendations to the provincial government, based on an actuarial report that supports their plan.

Concerned members can contact the Liaison Committee.

Inflation Protection (Cost-of-Living Adjustment)

A pension with inflation protection —also called indexing— means your monthly payments increase over time to help keep pace with rising costs on things like groceries and rent.

At CSSB, cost-of-living adjustments are not guaranteed, but retired members have typically received them in most years. The level of increase depends on available funds and may only be a partial increase.

Once given, adjustments are yours for life.

How increases are funded

When you were a working member contributing to the pension plan, your payments went into two accounts:

- Civil Service Superannuation Fund (89.8%)

This account funds the pension. - Cost-of-Living Adjustment Account (10.2%)

This account funds cost-of-living increases and pays for about half of each increase. The remainder of the increase is paid for using investment income and employers pay the rest.

How increases are decided

Each year, an actuary determines if an increase can be given and how much it should be.

They look at two main factors:

- The prior year’s Canadian Consumer Price Index (this measures inflation)

- The money available in the Cost-of-Living Account

Decision points

- If there is enough money in the account to cover all cost-of-living payments for the next 20 years, then the full cost-of-living increase is given. Using the 20-year standard is a safeguard for ensuring long-term security.

- If there is not enough money in the account to cover all cost-of-living payments for the next 20 years, the increase can’t be more than 66.67% of the Canadian Consumer Price Index for the previous year. For example, if the index was 10%, the increase can’t be more than 6.67%.

• This limit is set out in the Civil Service Superannuation Act.

• Depending on the funds available, the increase may be lower than 66.67%. - The actuary shares their recommendation with the Board. The Board can either accept or change the recommendation.

Canadian Consumer Price Index

Statistics Canada developed the Canadian Consumer Price Index to measure inflation. To do this, they compare the cost of the same goods and services (e.g., food, housing, clothing) at different points in time to see if prices go up.

Important to know

- Increases are not guaranteed.

- Once given, increases are part of your pension for life.

- Increases are based on the lifetime pension amount, regardless of the payment option you chose at retirement. If you selected an option that provides a different payment structure (e.g., two-thirds to survivor), your cost-of-living increases will still be calculated based on the original lifetime pension amount.

- When you (a retired member) pass away and your pension continues to a spouse, common-law partner, or other beneficiary, increases reduce to two-thirds or 66.67%.

When increases are given

If a cost-of-living adjustment is approved, your first increase is given in the 13th month after you retire and then every July after that.

- If you have been retired for 13 to 18 months on July 1 (meaning you retired between January 1 and June 30 of the prior calendar year), you will receive a partial increase in the 13th month and in July of the same year.

- When you have been retired for 18 months or more, you will receive a full cost-of-living adjustment in July.

For example, if you retired in April 2023:

- May 2024 – first increase (pro-rated to the 13th month after retirement)

- July 2024 – partial increase (as you have not yet reached 18 months of retirement)

- July 2025 – first full cost-of-living adjustment

This schedule ensures all members eventually align with the plan’s annual adjustment cycle in July.

2024 increase

2024 cost-of-living adjustment: 1.2%

2023 Canadian Consumer Price Index: 3.4%

66.67% target => 35.3% achieved

History

You can't include multiple times the same chart.

Before to 1977, cost-of-living adjustments were granted on an ad hoc basis.

Inflation, longevity, and retirements: A funding challenge

The cost-of-living account is struggling to meet its target for several reasons:

- Rising inflation

- The funding formula

- Changes to membership

- Increased longevity

Rising inflation

Higher prices for goods and services require larger increases.

You can't include multiple times the same chart.

The Funding Formula

With the current funding formula, contributions can’t keep up with payments.

You can't include multiple times the same chart.

Changes to membership

In 1977, there were 12 employees contributing to the account for every one pensioner receiving an adjustment. Now there are only 1.2 employees for every pensioner receiving an adjustment.

Increased longevity

Between 1970 and 2025, Canada’s life expectancy increased from 72 to 83, growth of almost 11 years.1 While increased longevity is worth celebrating, pensions must now stretch further and adjust more often.

Concerns for the future

If pension payments stay the same while costs continue to rise, pensioners lose buying power, leading to a lower standard of living. For over 20 years, the Board and actuary have warned that the cost-of-living account can’t meet its target. They have also indicated this trend is likely to continue unless changes are made.

Changes start with two committees:

- Superannuation and Insurance Liaison Committee (representing employees)

- Employer Pension and Insurance Advisory Committee (representing employers)

Both committees must make recommendations to the provincial government, based on an actuarial report that supports their plan.

Concerned members can contact the Liaison Committee.