Employees

Employees – Frequently Asked Questions

Information for employees who are new to the plan, getting ready to retire, or somewhere in between.

General Employee Information

Qualifying Service is employment (or combined periods of employment) that is unbroken by resignation, termination or retirement except for a temporary absence/layoff. A temporary absence/layoff is considered to be a period of employment if the absence/layoff does not exceed 54 consecutive weeks.

You have met the Rule of 80 when the combination of your age (minimum age 55) and qualifying service equals 80 or more (e.g., age 55 with 25 years of qualifying service or more). There is no early retirement reduction if you retire between the ages of 55 and 60 with the Rule of 80.

The CSSB is required by The Pension Benefits Act to have the Annual Employee Pension Statement available for the prior year by the end of June.

Members who are signed up for the CSSB Online Services will receive an email notification when their statement is ready and available for download.

If you are a new member and did not contribute to the pension plan in the previous year, you will not be able to run termination or pension estimates until our office receives the year end information from your employer.

If you find a discrepancy in your pensionable earnings, please contact your employer.

You can update your spouse/partner’s information (date of birth and name) and address by going to “Edit My Profile” in your Online Services account.

- You may have been on a leave of absence without pay. If you are on a leave of absence without pay, you do not contribute to the pension plan and your employer would not report pensionable service during this time.

- You may have received retroactive pay which has been allocated back to the applicable year(s).

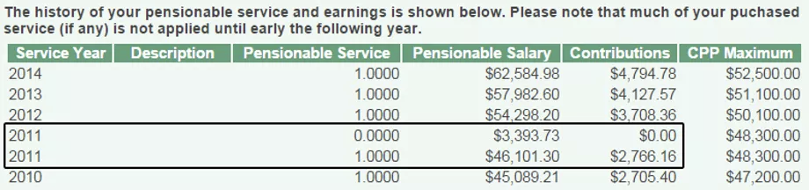

In the above case, this member received retroactive pay in 2011 which pertains back to a previous year. In the account history, these earnings are identified on a separate line.

No. Voluntary contributions are not permitted.

No. Borrowing contributions from a Registered Pension Plan is prohibited under the Income Tax Act and The Pension Benefits Act.

No. The Government of Canada’s Home Buyers’ Plan (HBP) applies only to withdrawals from Registered Retirement Savings Plans.

The Civil Service Superannuation Fund isn’t eligible under the HBP, and there are no provisions in the pension plan that permit funds to be withdrawn while still employed.

The exception to this would be for members who have non-locked-in funds in the Money Purchase Plan. Non-locked-in funds in the Money Purchase Plan may be removed at any time. Although the Money Purchase Plan isn’t an eligible plan under the HBP, a member could transfer their non-locked-in funds to an RRSP.

Retirement

You have two (2) options. You can:

- Run your own estimate using Online Services

If you are registered for Online Services, you can run pension estimates and termination estimates using your actual account information and the same calculator we use in our office. This allows you to access the information when it’s convenient for you. You can also complete your retirement forms using the “Complete Retirement Forms” feature of Online Services.

- Request a pension estimate from our staff

You can contact our office to request a pension estimate.

The normal retirement age for all members is 65. The earliest retirement age is 55, except for Correctional Officers who could retire as early as age 50 provided the member’s age plus qualifying service add up to at least a total of 75.

Suggested reading: Applying for a Retirement Pension.

Your pension is a benefit that you apply for. It is not automatically paid upon retirement. The following steps will assist you in the application process for your CSSB retirement pension:

- Select your retirement date and ensure that you are eligible to retireThe Plan allows a retirement date to be any day of the year. You can retire if you are at least age 55, are no longer an employee in the Plan and have provided a Notice of Retirement to the Board. If you are a Correctional Officer, you can retire between ages 50 and 55 if the combination of your age and service totals at least 75.

- Notify your Employer of your intention to retireWe do not notify your employer of your retirement. You must contact your Human Resources department or Pay and Benefits office to notify them of your retirement date. You will be required to provide your employer with a written retirement notice prior to your pension commencement date. You may want to confirm with your employer how much advance notice is required.

- Obtain a pension estimate and retirement forms

- a) From the CSSB office: You can request retirement forms and a pension estimate from our office up to six (6) months prior to your retirement date. OR

- b) From Online Services: If you are registered for Online Services, you can obtain pension estimates and complete your retirement forms online. This feature allows you to print your completed forms for signature and submission to the CSSB office, or you can have CSSB print your completed forms and mail them to you for your signature and submission. Automatic edits in the online process help reduce potential problems and errors.

- Submit your completed retirement forms to CSSB prior to your retirement dateIt is important that you provide your retirement forms and supporting documentation to CSSB before your retirement date. A delay in submitting forms may result in a loss of pension payments, and certain defaults may apply.You can arrange to meet with our office staff who can answer any questions you may have and assist you with completion of your retirement forms.

- Provide your proof of age documentWe require your proof of age and will accept a photocopy of one of the following:

- birth certificate,

- valid Canadian passport,

- valid drivers license,

- Canadian Citizenship card or

- Permanent Resident card.

If you have a spouse or common-law partner who is the beneficiary of a survivor pension, we will also require a copy of their proof of age.

Your pension is calculated as follows:

2% of your Best Five Year Average Pensionable Earnings multiplied by pensionable service

minus

0.4% of the Average Canada Pension Plan Pensionable Earnings multiplied by your pensionable service

Note: Of the pension you receive, the Income Tax Act may limit the amount that can be paid from a registered pension plan. Any amount above that limit would be paid as unregistered pension.

A retroactive salary adjustment may increase your pension if it increases your Best Five Year Average Pensionable Salary.

Salary for pension purposes is defined in The Civil Service Superannuation Act and includes your regular remuneration (with any eligible vacation cash-out) and excludes anything else that does not form part of your regular remuneration. Regular remuneration is typically determined by the employer and may be defined in a collective agreement or employment contract. If a retroactive increase is considered by the employer as pensionable salary, the employer will report that salary to the CSSB.

We would do a recalculation to include retroactive salary paid to a former employee who has resigned, been dismissed, or died, if the former employee or his or her spouse, common-law partner or eligible survivor is entitled to a pension.

Vacation pay paid in lieu of time off when you are still employed is not pensionable and employee contributions will not be deducted by your employer.

Vacation pay paid on termination or retirement can be included as pensionable earnings up to the lesser of:

- 2 years of regular vacation accruals (based on the most recent 2 years of service prior to termination or retirement), or

- 50 days

Please note that the maximum accrual rate is reduced proportionately if you worked on a part-time basis.

This maximum accrual relates only to the number of days of vacation pay that can be included as pensionable earnings and for which employee contributions are to be deducted. Any vacation days over and above this limit will be paid to you by your employer but will not be included as pensionable earnings and no employee contributions will be deducted.

For example, if an employee is working part-time at 50% and has 6 weeks of vacation entitlement in a year, the maximum vacation days that would be available to include in pensionable earnings would be 30 days.

- 1st year accrual: 6 weeks x 5 days x 50% = 15 days

- 2nd year accrual: 6 weeks x 5 days x 50% = 15 days

- Maximum # of vacation days for pension = 30 days

Confirm with Payroll or HR about the accrual and cashout of your vacation days and what rules, if any, the employer has with regards to how they allow you to bank the days for pension purposes. We do not look after the accumulation or pay out of vacation days. Your employer will report to us how many unused vacation days you are paid out at the time of retirement.

There is nothing in the pension plan rules that prevent a member who is receiving a pension from returning to work. However, once you commence receiving a monthly pension from the Fund, you are not allowed to re-enter the pension plan as an active contributing member. You can be employed with a participating employer, but you will not be allowed to have employee contributions deducted and will not accrue any further new benefits under the pension plan.

If you return to work with an employer who does not participate in the Civil Service Superannuation Fund, you would be able to join that employer’s pension plan (if they have one and you are otherwise eligible).

We’re not aware whether a member will be entitled to severance or to how much he or she might be entitled. Please contact your employer for information on severance.

This is a personal decision. Integration is an option that lets you get a higher pension from the pension plan until age 60 for Canada Pension Plan (CPP) integration and age 65 for Old Age Security (OAS) integration but less pension from the pension plan after those ages. Because your benefits from these three plans can all start at different times, this option may help you level out your income through retirement.

If you retire before age 60 you can integrate your pension with OAS or CPP, or both. If you retire after age 60, but before age 65, you can integrate your pension with OAS. Integration is not available if you are at least age 65 when you retire.

With an integrated pension, you would receive an additional amount of pension from the pension plan until age 60 for integration with CPP and age 65 for integration with OAS. These additional amounts would then cease and your basic pension would be reduced. This reduction is intended to recover the additional amounts previously paid to you. This reduction continues for your lifetime. The plan recovers on average the same amount it pays out. However, as the repayment amounts are based on average life expectancy, each individual may pay back more or less than they received, depending on how long he or she lives.

If you are being paid a minimum guaranteed pension (e.g., 10 or 15 years), CPP integration adjustments would cease upon your death and would not impact any payments made to a beneficiary. If you are under age 65 when you pass away, OAS integration increases would continue to be paid until the earlier of the date you would have reached age 65, or the end of the minimum guarantee period. No reduction to recover the additional amounts paid would be made to a beneficiary payment.

For any form of pension other than a minimum guaranteed pension, integration adjustments apply only during your lifetime, and any increase or decrease would cease upon your death. Survivor pension option amounts payable to a spouse or partner would therefore be no different whether you integrate or not.

Please note that selecting the integration option will not cause your CPP or OAS benefits to start automatically. If you select the integration option, any reductions to your pension from the pension plan at age 60 or 65 will occur as scheduled, regardless of when your CPP and OAS benefits start, how much you actually receive, or any changes that might be made to those plans.

“The Risk: Taking advantage of this early retirement option is a gamble in the sense that individuals may be paying back the debt longer than they collected the benefit.” (Provincial Ombudsman Report)

Spouse or Partner Consent for Integration Election

We are unable to pay an integrated pension to a member with a spouse or common-law partner unless the spouse or common-law partner has provided written consent to the election or the member is living separate and apart from the spouse or common-law partner by reason of a breakdown of their relationship.

This consent can only be given by completing a form required by the Superintendent of Pensions (Form 5B).

Depending on when you submitted retirement forms, our office may not have had enough time to set up your payment before the pensioner payroll was being processed.

Your pension is payable from your date of retirement, and your first monthly payment will be pro-rated if you retire part way through a month. However, in order to make sure that your first pension payment is not delayed, it is important that your completed retirement forms and supporting documentation are provided to us at least a month or two prior to your retirement date.

If you retire before the age of 60 and do not meet the Rule of 80, a bridging benefit would be paid to you until age 65. Bridging offsets a portion of the reduction for early retirement.

Ceasing Employment

The transfer value is the present value of future benefits as determined by the Fund’s Actuary. The transfer value calculation takes into account the amount of the pension benefit, how far away you are from commencing the pension, your age, and actuarial assumptions regarding mortality and interest rates.

Based on your age and pension benefit accrued at the time of the calculation of your transfer value, the Income Tax Act and Regulations have formulas to determine the maximum value that is eligible for transfer from a pension plan on a tax deferred basis. If the transfer value of your pension is greater than this maximum value, the amount in excess cannot be transferred directly to an RRSP or LIRA and must be paid in cash less applicable withholding tax.

You will need to claim this excess as a refund from the pension plan in the year it is paid. A T4A will be issued at the time the refund is paid. You should keep this form with your income tax documents.

The CSSB will not accept a copy of your CRA assessment notice as proof that you have RRSP room available for transferring funds. If you have RRSP room and you intend to contribute your registered pension excess or excess contributions to an RRSP, you could complete a Request to Reduce Tax Deductions at Source for Year (T1213) form available from the CRA website. If approved, CRA will provide you with a letter authorizing payment with less or no income tax deducted. The Board office would require a copy of that letter so that we can reduce the tax withholding as authorized. It will then be your responsibility to deposit the funds in your RRSP.

Please ensure that the Employer/Payer is listed as “Civil Service Superannuation Fund”, as the taxable cash payment is being made from the pension plan and not your employer. We will not accept an authorization letter that shows the employer as payer.

If you wish to pursue this with CRA, you should make an application as soon as possible as it may take some time before you receive your letter of approval or denial from CRA. No extensions will be granted if the CRA letter is not received prior to the deadline for submitting completed forms and documents. Once you receive your letter from CRA, please forward a copy of the letter along with your termination option form and appropriate documents. The cash portion of your entitlement would be paid to you directly and you would then be responsible for depositing it into an RRSP.

If you previously contributed and have re-entered the Plan, you may be eligible to reinstate your prior account. Reinstatement is the option of combining pensionable service from a prior Fund account into a new Fund account, which allows the pension for the prior period to be determined including the salary in the new account.

Previously accumulated pensionable service can be reinstated if:

- you did not withdraw or transfer any portion of the pension benefits for that service;

- you re-enter the Plan within three years of leaving; and

- you apply within two years of re-entering the Plan.

Note: If you transferred pension benefits in respect of a prior period because you were required under the Act to do so, you may be eligible to reinstate that service (subject to the applicable time deadlines), if you repay any amount refunded (if applicable) plus whatever amount is necessary to reinstate the account.

Contact the Board office to determine if you are eligible to reinstate prior service.

You may commence your deferred pension at any time after age 55. Within six months prior to the date you want to commence your pension, you can either complete your retirement options online or request a retirement package from the Board office.