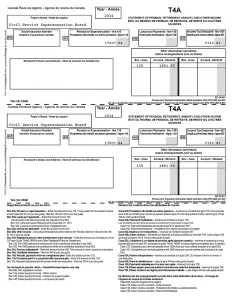

Your T4A or NR4

The T4A or NR4 (for non-residents of Canada) is required when you file your income tax return. It shows the total amount of pension paid to you during the previous calendar year and the total income tax deducted.

The CSSB distributes tax slips (T4As or NR4s) to pension recipients in January/ February for the prior tax year.

Registered for CSSB Online Services,

If registered for CSSB Online Services, you will receive an email notification when your T4A or NR4 is available in your Online Services account. Pensioners who use Online Services will generally be able to access their tax slips earlier than those who receive them by mail, and can generate copies at their convenience.

To obtain an electronic copy of your T4A or NR4:

- Sign into CSSB Online Services.

- Select Inbox (Document Centre) from the menu on the left.

- Click the download icon beside the document listed in your inbox as: “T4A – 2022” or “NR4 – 2022”.

- If the document doesn’t open automatically in a new window, obtain it from the folder in which you normally download documents on your computer or device.

NOTE: The CSSB will not send a paper copy of your tax slip if you obtained your tax slip online before the mail out date in mid-February.

Not registered

For those not registered for the CSSB Online Services or who have selected “mailed T4A” using Online Services, your T4A or NR4 will be mailed by the end of February.

Box 28

For members who received a refund from the Public Service Group Insurance Fund in May 2022: the amount of the refund is outlined in Box 28 – Other Income on your 2022 T4A or NR4.

Important note: If mail is returned from the last known address of the pension recipient, the CSSB will make reasonable attempts to contact the recipient and update the information. Upon the discretion of the CSSB, further pension payments may cease until satisfactory contact is made.